De wereld, en met name de Verenigde Staten, beleefde in de jaren twintig van de vorige eeuw een hoogconjunctuur. Als gevolg hiervan stegen de koersen van aandelen en andere effecten tot enorme hoogten, aandelen werden op de beurs veel meer waard dan redelijk was. De onderliggende economie was echter ongemerkt in kracht verminderd, zonder dat dit op de beurs tot uiting kwam. Beleggers verkeerden in euforie, en de prijzen van de aandelen werden steeds maar verder opgejaagd, dit tegen alle economische logica in. (1)

De oorzaak dat de Dow Jones naar ongekende hoogte steeg was mijns inziens de introductie op 1 oktober 1928 van een nieuwe berekening van de Dow; de introductie van de Dow-divisor, het uitbreiden van de dow van 20 naar 30 aandelen op 1 oktober 1928 en het splitsen van aandelen in de periode oktober 1928 – november 1929, de laatste fase van de versnellingsfase van de 2e industriele revolutie. Deze drie factoren zijn er de oorzaak van dat de Dow in de periode oktober 1928 tot september 1929 exponentieel is blijven stijgen (van 238 naar 381 punten), terwijl de onderliggende economie sterk in kracht was verminderd.

Transities

Iedere productiefase, of iedere maatschappij of ander menselijk verschijnsel, doorloopt een zogenaamd transformatieproces. Transities zijn maatschappelijke transformatieprocessen, die tenminste één generatie beslaan. In dit artikel wil ik aan de hand van zo’n transitie aangeven, waar we met onze huidige maatschappij staan en wat voor gevolgen dat kan hebben voor de beursindexen.

Transities hebben de volgende eigenschappen (2):

- het betreft een structurele verandering van de (wereld)-maatschappij, of een complex deelsysteem daarvan;

- er is sprake van op elkaar inwerkende en elkaar versterkende technologische, economische, ecologische, sociaal-culturele en institutionele ontwikkelingen op verschillende schaalniveaus;

- het is de resultante van langzame veranderingen (ontwikkelingen in voorraden) en snelle dynamiek (stromen).

Een transitie ligt niet bij voorbaat vast, omdat er gedurende een veranderingsproces altijd sprake is van aanpassen aan, leren van, en inspelen op nieuwe situaties. Een transitie is dus geen wetmatigheid.

Vier transitiefasen

(3)

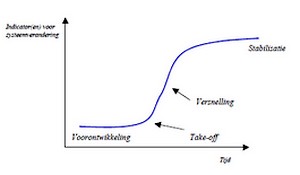

In het algemeen beschrijven transities de S-curve en zijn vier transitiefasen te onderscheiden (zie ook figuur 1):

- een voorontwikkelingsfase van dynamisch evenwicht waarin de status-quo niet zichtbaar verandert;

- een ‘take-off’-fase waarin het veranderingsproces op gang komt, doordat de toestand van het systeem begint te verschuiven;

- een versnellingsfase waarin zichtbaar structurele veranderingen plaatsvinden door een cumulatie van op elkaar inspelende sociaal-culturele, economische, ecologische en institutionele veranderingen; in de versnellingsfase is sprake van collectieve leerprocessen, diffusie en processen van inbedding;

- een stabilisatiefase waarin de snelheid van maatschappelijke verandering afneemt en al lerend een nieuw dynamisch evenwicht wordt bereikt.

Ook een productlevenscyclus en een bedrijfslevenscyclus beschrijven een S-curve. In dit geval is er nog een vijfde fase: de aftakelingsfase, waarin kosten stijgen door overcapaciteit en waarin een producent zich uiteindelijk terugtrekt uit de markt.

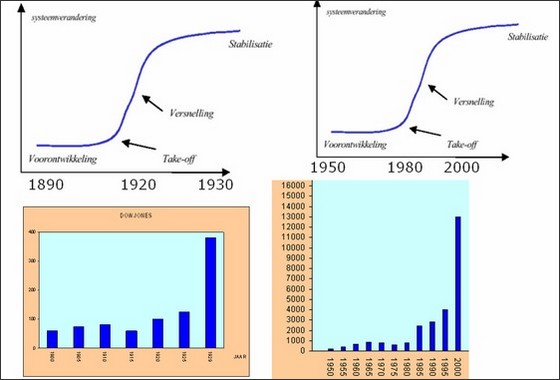

Als we de geschiedenis induiken, hebben in de laatste twee eeuwen drie ingrijpende transities, ook wel industriële revoluties genoemd, plaatsgevonden (4):

- De 1e industriële revolutie (1780 tot circa 1850); de stoommachine

- De 2e industriële revolutie (1870 tot circa1930); electriciteit, olie en auto

- De 3e industriële revolutie (1950 tot ….); computer en microprocessor

De Dow Jones Industrial Average (DJIA) index is de oudste aandelenindex van de Verenigde Staten. Een select clubje journalisten van The Wall Street Journal beslist welke bedrijven deel uitmaken van invloedrijkste beursindex ter wereld. In tegenstelling tot de meeste andere indices is de Dow een prijsgewogen index. Het bepalen van de beursindexwaarden zoals de Dow en de weergave van deze index in historische grafieken zijn een perfecte manier om aan te geven in welke fase een industriële revolutie zich bevindt.

Laatste revoluties en de Dow Jones

Laatste revoluties en de Dow JonesDow Jones-index (grafiek) was (is) een fata morgana

In veel grafieken is de y-as een vaste eenheid, zoals kilo, meter, liter of euro. Bij de index-grafiek lijkt dit ook zo, want op de y-as wordt een eenheid in punten gebruikt. Niets is echter minder waar! Een index-punt is namelijk geen vaste eenheid in de tijd en je mag er dan ook historisch gezien geen enkele betekenis aan hechten.

Een index wordt berekend aan de hand van een mandje aandelen. Bij elke index gebeurt dat volgens een bepaalde formule en de uitkomst van de formule levert een aantal punten op. Een grote fout die veel mensen maken is, dat er waarde gehecht wordt aan deze grafieken. Deze grafieken zijn echter erg bedriegelijk.

De Dow wordt voor het eerst gepubliceerd in 1896. De index wordt berekend door de som van de aandelen te delen door twaalf:

Dow-index_1896 = (x1 + x2+ ……….+x12) / 12

Een index wordt berekend aan de hand van een mandje aandelen. Bij elke index gebeurt dat volgens een bepaalde formule en als uitkomst krijg je dan een aantal punten. Dat mandje van aandelen wordt bij elke index echter regelmatig veranderd. Voor de nieuwe periode wordt dus de waarde van een ander mandje aandelen gemeten. Het is natuurlijk vreemd dat je de verschillende mandjes als zelfde eenheid projecteert. Na een periode van vijfentwintig jaar werd de waarde van een mandje met twaalf appels vergeleken met de waarde van een mandje dertig peren. Er zaten in 1929 nog maar twee van de twaalf oorspronkelijke bedrijven in de Dow.

Het meest vreemde is natuurlijk de steeds wijzigende samenstelling van het mandje. Over het algemeen is het zo dat bij het wijzigen van het mandje, bedrijven die in een stabilisatiefase of de aftakelingsfase van hun cyclus (“oud bloed”) zitten, uit het mandje gehaald worden. Bedrijven die in de ‘take-off’-fase of versnellingsfase van hun cyclus (“nieuw bloed”) zitten worden toegevoegd. De kans dat de index na de wijziging van het mandje en de formule stijgt, is dan natuurlijk vele malen groter dan dat de index gaat dalen. Daar hoef je geen kansberekening op los te laten, met name als deze methode wordt toegepast in de versnellingsfase van een transitie. In 1916 wordt de Dow uitgebreid naar twintig bedrijven; er verdwijnen vier bedrijven en er komen twaalf nieuwe bedrijven bij.

Dow-index_1916 = (x1 + x2+ ……….+x20) / 20

Door deze berekeningswijze wordt een soort piramidespel gecreëerd. Dit gaat goed zolang er bedrijven die in de ‘take-off’-fase of versnellingsfase van hun cyclus zitten, worden toegevoegd. Aan het eind van een transitie zullen dit er echter steeds minder worden.

Van een aantal bedrijven zijn in de loop der tijd de aandelen gesplitst en voor die aandelen wordt een wegingsfactor in de berekening meegenomen. De formule ziet er als volgt uit (American Can wordt met 6 vermenigvuldigd, General Electric met 4).

Dow-index_1927 = (6.x1 + 4.x2+ ……….+x20) / 20

Echt bizar wordt het bij de wijzigingen die op 1 oktober 1928 op de Dow Jones worden doorgevoerd.

Op 1 oktober 1928 wordt de Dow Jones verder uitgebreid naar dertig aandelen. Omdat men nog alles met de hand moet uitrekenen wordt de berekening van de index eenvoudiger. Men introduceert de Dow Divisor. De index wordt berekend door de som van de aandelen te delen door de Dow Divisor.

Omdat de index op 1 oktober 1928 niet mag veranderen, krijgt de Dow Divisor de waarde 16.67. De index-grafiek van de twee tijdsperioden moet per slot van rekening wel op elkaar aansluiten.

Op 1 oktober 1928 wordt de Dow Jones verder uitgebreid naar dertig aandelen. Omdat men nog alles met de hand moet uitrekenen wordt de berekening van de index eenvoudiger. Men introduceert de Dow Divisor. De index wordt berekend door de som van de aandelen te delen door de Dow Divisor.

Omdat de index op 1 oktober 1928 niet mag veranderen, krijgt de Dow Divisor de waarde 16.67. De index-grafiek van de twee tijdsperioden moet per slot van rekening wel op elkaar aansluiten.

Dow-index_okt_1928 = (x1 + x2+ ……….+x30) / 16.67

De Dow staat op 1 oktober 1928 op 239, dus de som van de aandelen is 3984 dollar.

Vanaf dat moment levert een waardestijging (of daling) van het mandje bijna tweemaal zoveel (of minder) indexpunten op. Bij de oude formule zou de som worden gedeeld door dertig.

Bij elke wijziging in het mandje van de Dow, krijgt de Dow Divisor een andere waarde. Dit gebeurt omdat de index, de uitkomst van de twee formules van beide mandjes, op het moment van verandering dezelfde uitkomst moet opleveren. Ook bij een aandelensplitsing wordt de Dow Divisor om dezelfde reden aangepast.

In het najaar van 1928 en het voorjaar van 1929 vinden er acht aandelensplitsingen waardoor de Dow Divisor daalt naar 10.47.

Dow-index_sept_1929 = (x1 + x2+ ……….+x30) / 10.47

Vanaf dat moment levert een waardestijging (of daling) van het mandje bijna driemaal zoveel (of weinig) indexpunten op dan een jaar eerder. Bij de oude formule zou de som worden gedeeld door dertig. De Dow heeft op zijn hoogtepunt, 3 september 1929, namelijk 381 punten.

De extreme stijging en daarna de extreme daling van de Dow in de periode 1920-1932 is dus vooral veroorzaakt door rekenkundige veranderingen van de Dow, de voortdurende wijziging van het mandje in de versnellingsfase van de tweede industriële revolutie en de aandelensplitsingen die in deze periode hebben plaatsgevonden. Door deze wijzigingen in de Dow zijn beleggers natuurlijk volledig op het verkeerde been gezet. De onderliggende bedrijven die de Dow destijds droegen, kwamen echter ook in de stabilisatie- en aftakelingsfase.

Déjà vu

Tijdens de versnellingsfase van de derde industriële revolutie vanaf 1980, door de komst van de microprocessor, heeft de geschiedenis zich herhaald. Het mandje van de Dow is in deze periode bijna volledig vervangen. Vele aandelensplitsingen hebben plaatsgevonden, waardoor de Dow Divisor weer sterk is veranderd. De Dow Divisor bedraagt momenteel 0,132319125, terwijl in 1985 deze deler nog meer dan 1 was.

Dow-index_1985 = (x1 + x2 + ……..+x30) / 1.116

Dow-index_2009 = (x1 + x2 + …….. + x30) / 0,132319125

Dit verklaart weer de exponentiële stijging van de Dow-grafiek in de jaren negentig. Een koersstijging van 1 dollar van het mandje in 2009 levert dus de facto 8,4 meer indexpunten dan in 1985 (bij daling gebeurt het tegenovergestelde). Vandaar dat we de laatste jaren ook extreme uitslagen zien. Momenteel staat de Dow op 9665; bij het hanteren van de formule uit 1985 zou de index nu op 1150 staan. Ook nu zijn beleggers weer op het verkeerde been gezet.

De echte melt-down van de Dow vond destijds plaats na de beurscrach van oktober 1929. In de periode 1930-1932 daalde de Dow verder van 230 naar uiteindelijk 41 punten. Cruciale vraag blijft natuurlijk, of de huidige onderliggende economie sterk genoeg is om de Dow op het huidige peil te houden. Zullen de onderliggende bedrijven die de Dow momenteel dragen, dit keer niet in de stabilisatie- en aftakelingsfase terecht komen? Zullen er voldoende nieuwe bedrijven zijn om als nieuwe dragers te fungeren? En wanneer zal dat zijn?

Ik roep de financiële wereld op, de formule waarmee de Dow wordt berekend, eens kritisch onder de loep te nemen. Blijft de huidige berekening in tact, dan zal bij een volgende transitie de belegger opnieuw met een kluitje in het riet worden gestuurd.

- Wim Grommen

Wim Grommen is van origine wiskunde/natuurkundedocent (tien jaar). hij geeft al vijfentwintig jaar trainingen op het gebied van automatisering, momenteel bij Transfer Solutoions in Leerdam. Hij heeft zich de laatste jaren verdiept in maatschappelijke transformatieprocessen en de S-curve.

Het artikel Beurskrach 1929, mysterie ontrafeld? is januari 2010 verschenen in het maandblad Technische & Kwantitatieve Analyse, een maandelijkse uitgave van Beleggers Belangen.

Bronvermelding:

1 – http://nl.wikipedia.org/wiki/Beurskrach_van_1929

2- Transities & transitiemanagement, casus van een emissiearme energievoorziening, Prof. dr. ir. Jan Rotmans e.a.

3 – Transities & transitiemanagement, casus van een emissiearme energievoorziening, Prof. dr. ir. Jan Rotmans e.a.

4 – Geschiedenis Werkplaatssite van Wolters-Noordhoff

2- Transities & transitiemanagement, casus van een emissiearme energievoorziening, Prof. dr. ir. Jan Rotmans e.a.

3 – Transities & transitiemanagement, casus van een emissiearme energievoorziening, Prof. dr. ir. Jan Rotmans e.a.

4 – Geschiedenis Werkplaatssite van Wolters-Noordhoff